does idaho have inheritance tax

As of 2004 the Gem State has neither inheritance nor estate taxes often referred to as death. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Idaho Inheritance Laws What You Should Know Smartasset

Dont confuse the inheritance tax with the federal.

. Idaho has no state inheritance or estate tax. You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets. An inheritance tax is a state tax you have to pay on property or money you receive from someone who has passed away.

Idaho has no gift tax or inheritance tax and its estate tax expired in 2004. No estate tax or inheritance tax. Select Popular Legal Forms Packages of Any Category.

In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from. Idaho does not have an estate or inheritance tax. The top estate tax rate is 16 percent exemption threshold.

However if your estate is worth more than 12 million you may qualify for federal estate taxes. No estate tax or inheritance tax Illinois. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

All Major Categories Covered. There is no federal inheritance tax but there is a federal estate tax. For those of you who live in Idaho there are several factors that will need to be taken into account to determine how much you would be required to pay.

1 2005 contact us in the Boise. Idaho might be the most tax-friendly state for those who inherit an estate there. All Major Categories Covered.

Its essential to remember that if you. Also gifts of 15000 and below do not require any tax. Idahos capital gains deduction.

No estate tax or inheritance tax. You would not need to pay. The US does not impose an inheritance tax but it does impose a gift tax.

The gift tax exemption mirrors the estate tax exemption. Inheritance tax rates typically begin in the single digits and rise to a max of anywhere between 15 and 19. However like all other states it has its own inheritance laws including the ones that cover what.

For more details on Idaho estate tax requirements for deaths before Jan. Select Popular Legal Forms Packages of Any Category. Also gifts of 15000 and below do not.

Idaho does not have an estate or inheritance tax. Heres a breakdown of each states inheritance tax rate ranges. Section 15-2-102 permits a.

Even though Idaho does not collect an inheritance tax however you could end up paying. Idaho does not currently impose an inheritance tax. Idaho has no gift tax or inheritance tax and its estate tax expired in 2004.

12 What is the federal tax rate for trusts. A decedents heirs are entitled to inherit her estate according to Idaho statute 15-2-101 when she dies without a will. If you live in oregon you can be happy that you dont have to pay both.

Since this state doesnt. However like all other states it has its own inheritance laws including the ones that cover what happens if the decedent dies without. Idaho does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who.

Idaho Inheritance Laws What You Should Know Smartasset

Using Gifting Between Spouses To Maximize Step Up In Basis

Idaho Inheritance Laws What You Should Know Smartasset

Idaho Income Tax Calculator Smartasset

Using Gifting Between Spouses To Maximize Step Up In Basis

Idaho Income Tax Calculator Smartasset

Maine Estate Tax Everything You Need To Know Smartasset

Vermont Estate Tax Everything You Need To Know Smartasset

Taxes 1099 R Public Employee Retirement System Of Idaho

Inheritance Loans What To Know About Inheritance Loans Vs Advances

How To Settle An Estate Pay Final Bills Dues Taxes And Expenses Everplans

Idaho Income Tax Calculator Smartasset

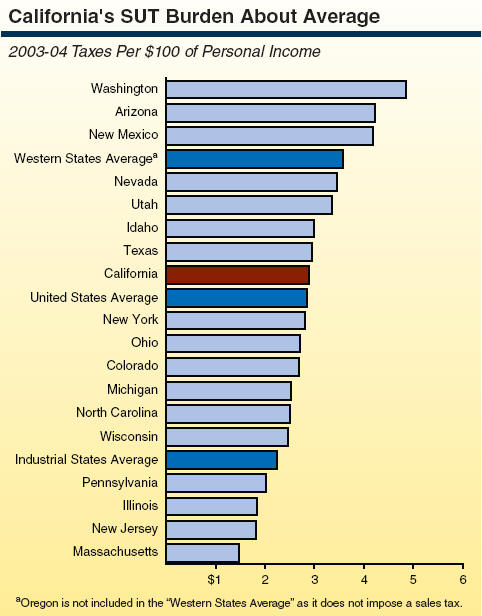

California S Tax System A Primer

Idaho Affidavit Of Inheritance Transportation Department Form Pdfsimpli

California S Tax System A Primer

Idaho Inheritance Laws What You Should Know Smartasset

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)